Withholding Statements Global Industry Forum

TAINA's 2 Part Global Industry Forum on Withholding Statements brought together over 50 of the world’s leading industry experts representing some of the world’s largest financial institutions and two of the Big 4.

Thanks to the feedback and input of the group TAINA's Managing Director Rasheed Khan has created the following to tools to help industry professionals with withholding tax.

- A data dictionary of withholding statement elements and definitions

- Withholding Statement templates as guideline for withholding statement

Standard Withholding Statement Templates

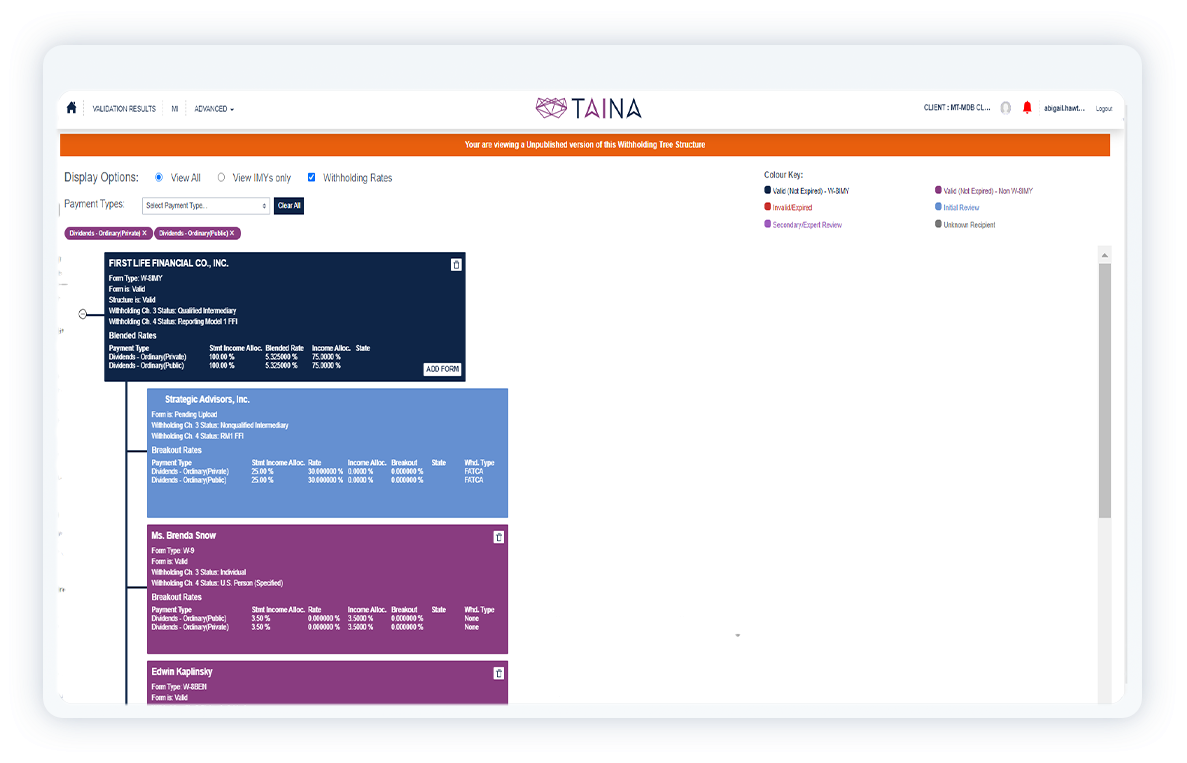

The withholding statement is a document that shows how income payable to an account is broken down between the beneficiaries of the account. We need to obtain this document from you in certain circumstances to validate your U.S. tax forms (W-8 forms): Where we need to establish your tax status in connection with the Foreign Account Tax Compliance Act (FATCA) legislation or where we pay U.S. source income to your account (such as income from U.S. investments that you hold with us). In most circumstances, we will only request a withholding statement where you provide us with a U.S. tax form W-8IMY.

Master Withholding Statement Templates

The master withholding statement is a document that provides all of the various types and levels of information to provide Withholding Agent information to calculate withholding and report income.

Simple Withholding Statement Template

The NQI, flow-through entity, or U.S. branch must give you certain information on a withholding statement that is associated with the Form W-8IMY. A withholding statement must be updated to keep the information accurate prior to each payment. Generally, a withholding statement must contain the information in lieu of the W-8 or W-9 form.

Detailed Withholding Statement Template

Certain institutions may require additional information on the withholding statement in absence of the form W-8 or W-9. The detailed statement contains all of the fields that are part of the simple statement but include additional fields to establish a presumed foreign status for FATCA.

Pooled Withholding Statement Template

If an NQI uses the alternative procedure, it must provide you with estimated temporary withholding rate pool information, as opposed to individual allocation information, prior to the payment of a reportable amount. A withholding rate pool is a payment of a single type of income (as determined by the income categories on Form 1042-S) that is subject to a single rate of withholding.

Alternative Withholding Statement Template

Under this alternative procedure the NQI can give you the information that allocates each payment to each foreign and U.S. exempt recipient by January 31 following the calendar year of payment, rather than prior to the payment being made as otherwise required. To take advantage of this procedure, the NQI must:

1.Inform you, on its withholding statement, that it is using the alternative procedure

2.Obtain your consent. You must receive the withholding statement with all the required information (other than item 5) prior to making the payment.